Orbs Liquidity Hub Expands to Sonic via SwapX

SwapX, a recently launched native CLAMM V4 DEX on Sonic has integrated Liquidity Hub by Orbs…

The integration empowers SwapX traders with access to a broader range of liquidity sources, combining both on-chain and off-chain options for competitive pricing.

Powered by Orbs’ advanced L3 technology and available on Sonic, Liquidity Hub offers key benefits, which include improved execution prices, MEV protection, gasless transactions, enhanced capital efficiency, and a streamlined user interface.

This integration significantly enhances the trading experience available on SwapX and for the first time, Sonic, providing traders with greater efficiency.

Liquidity Hub is a hallmark of innovation in the decentralized finance (DeFi) ecosystem, conceptualized and built by the Orbs project. It operates on the principles of complete decentralization, open access without permissions, and composability.

Thanks to this integration, traders leveraging SwapX on Sonic can now tap into the full liquidity potential offered by the network, further expanded by off-chain sources, for better swap prices without incurring any additional costs.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with tens of millions of dollars in TVL. The protocol optimizes on-chain trading with L3 use cases that include aggregated liquidity, advanced trading orders, and decentralized derivatives, enabling a DeFi trading experience as efficient as CeFi.

How Liquidity Hub Works

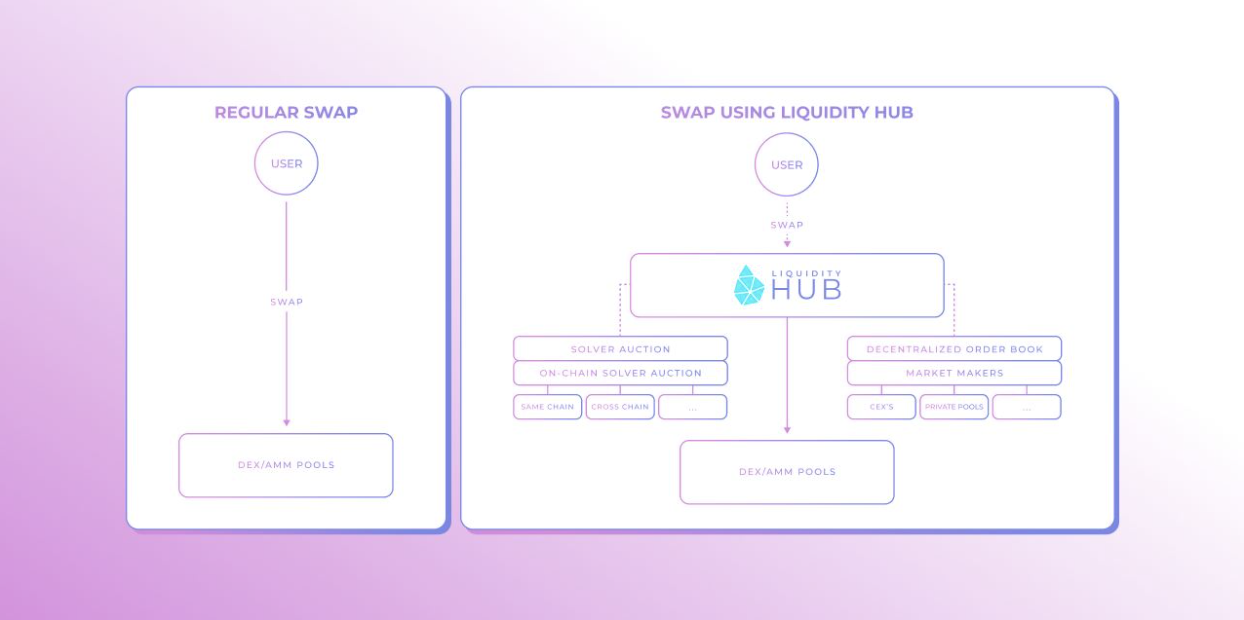

Liquidity Hub is a layer 3 (L3) infrastructure software powered by Orbs that provides an optimization layer above the AMM. This technology taps external liquidity for better price quotes and lower price impact.

Instead of the typical swap that searches for the best route within the DEX's limited liquidity pools, Liquidity Hub enhances this process by utilizing additional liquidity sources:

- On-chain solver auction: Third-party solvers who compete to fill swaps using on-chain liquidity like AMM pools or their private inventory.

- Decentralized orders via API: Decentralized orders are accessible using API, enabling institutional/professional traders, such as market makers, to submit bids and compete to fill swaps.

Continuing the Standard

The Liquidity Hub protocol, powered by Orbs L3 technology, has become the industry standard for achieving the best price across ecosystems.

To date, the protocol has been implemented in nine separate venues, each on a different chain. SwapX will join as the tenth integration. Headliners include Quickswap, THENA, Lynex, IntentX, and Fenix, among others.

If you have any questions regarding Liquidity Hub, please join Orbs’ Telegram channel.

Further readings: