Tea-Fi Integrates dLimit & dTWAP Order Types Powered by Orbs

Tea-Fi, the All-in-One DEX on Etheruem and Polygon, Integrates Orbs' dLIMIT and dTWAP Protocols! Becoming the first DEX on ETH to integrate TWAP/LIMIT orders by Orbs!

Tea-Fi has integrated the dLIMIT and dTWAP protocols powered by Orbs, enhancing its DeFi ecosystem with advanced trading functionalities! As a result, Tea-Fi traders now have access to both advanced order types, allowing them to set specific price conditions for their trades or split large orders into smaller transactions for optimized execution. This integration builds on Orbs' successful collaborations with other leading DEXs, further establishing its reputation as the go-to solution for advanced DeFi orders and showcasing its innovative Layer 3 technology, which brings CeFi-level execution capabilities to DeFi.

dLIMIT is a fully decentralized, permissionless, and composable protocol developed by Orbs and powered by the Orbs Network. Alongside limit orders, Tea-Fi has also integrated decentralized time-weighted average price orders (dTWAP) by Orbs, enabling traders to utilize this widely-used algorithmic trading strategy and further enhancing the platform's versatility as a comprehensive DeFi solution.

Orbs operates as a decentralized protocol managed by a public network of permissionless validators using PoS, with tens of millions of dollars staked in TVL. The protocol enhances on-chain trading with L3 use cases like aggregated liquidity, advanced trading orders, and decentralized derivatives, bringing an efficient CeFi-like trading experience to DeFi.

Trade with CeFi-level execution on a DEX

Tea-Fi continues to enhance its all-in-one DeFi offering with the integration of dLIMIT and dTWAP by Orbs, providing traders with advanced tools to optimize their trading strategies and execution efficiency. These additions mark a significant step forward in Tea-Fi's commitment to delivering a comprehensive and innovative trading experience.

For those unfamiliar, a limit order allows users to buy or sell tokens at a specific price. While the specified price sets a clear condition for execution, the order is only fulfilled if the market price meets these specifications.

In contrast, a TWAP order is a trading strategy that breaks large trades into smaller portions executed over time, reducing market impact and price volatility. This gradual approach enables traders to acquire or sell assets more efficiently, particularly in the fast-moving world of DeFi, where prices frequently fluctuate.

Setting up a dLIMIT and dTWAP orders

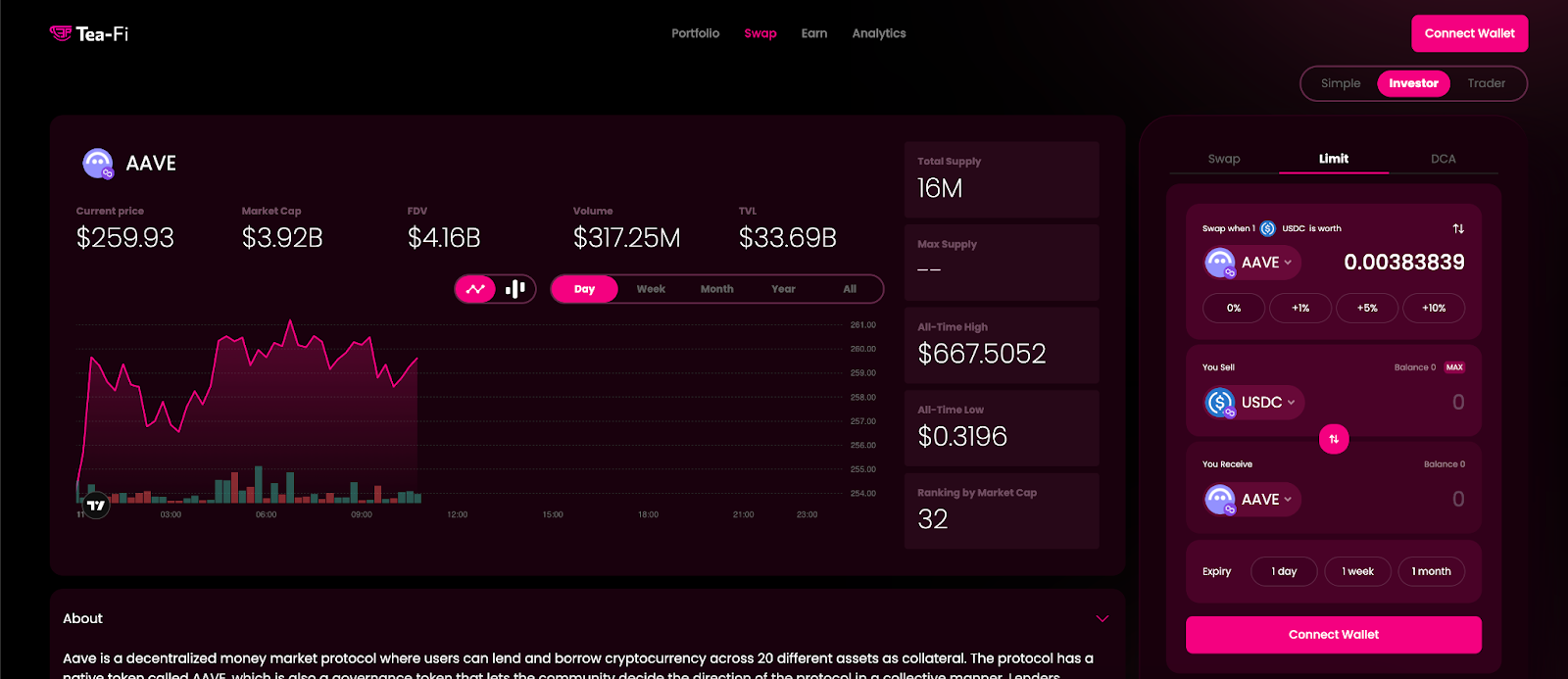

When switching to a dLIMIT 'swap' on Tea-Fi, users are presented with an easy-to-follow user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLIMIT order, traders must specify the following:

- From: The token that they currently have

- To: The token that they wish to swap for

- Limit price: Trades will ONLY be executed when the available market price is equal to or better than the Limit price.

dLIMIT takes into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order live in the 'order history' tab.

For a dTWAP order, three additional parameters need to be specified:

- No. of Intervals: allows the user to specify the number of individual trades. The UI automatically calculates the total number of transactions required to complete the entire order and the estimated trading interval.

- Max Duration: the maximum time during which the total amount of individual trades making up the full dTWAP order may be executed.

- Trade Interval: sets the time gap between each individual trade. The user can edit this parameter, which also results in changes to the corresponding trade size and number parameters.

Similarly to dLIMIT, these parameters provide incredible flexibility in customizing each order, taking into account factors like market conditions and current gas fees. Additionally, the UI facilitates both dTWAP-market orders, which execute all trades at the available market price, and dTWAP-Limit orders, which only execute individual trades if they are within the price Limit set by the user. Once these parameters are set, the user can approve the specific source token, place the order, and confirm their specified configuration.

Redefining Trading Standards on Decentralized Exchanges

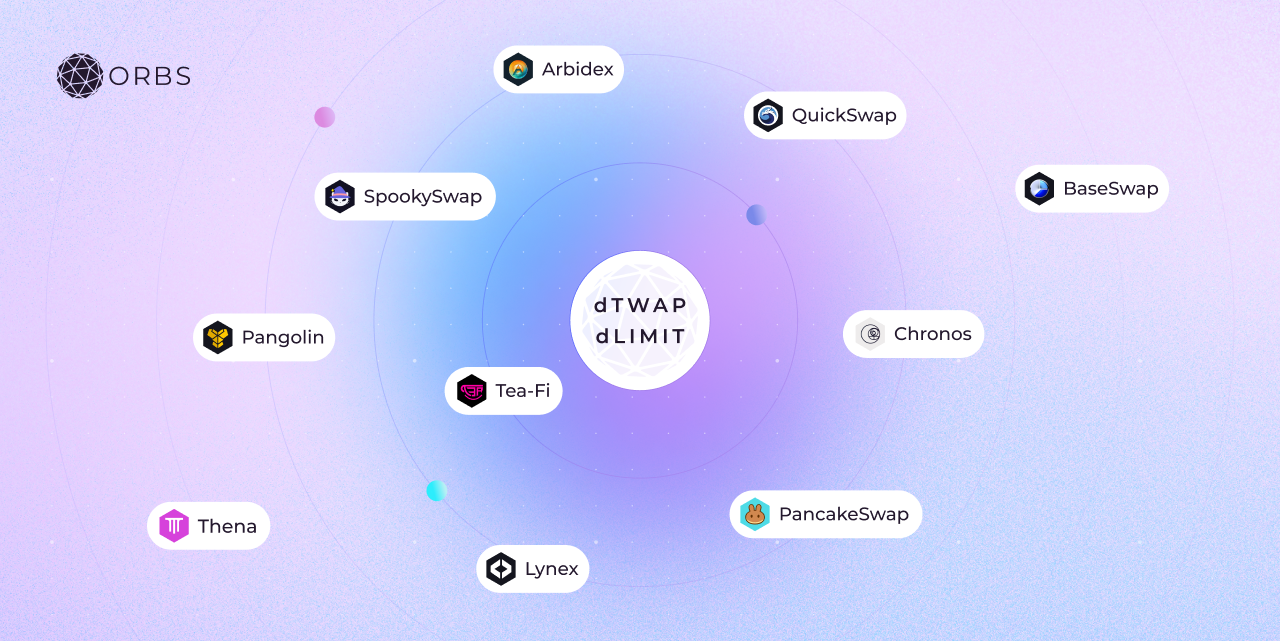

The dLIMIT & dTWAP protocols, powered by Orbs L3 technology, have become the industry standard for decentralized algorithmic orders in DeFi. The 'powered by Orbs branding' has become a staple of confidence when executing advance orders on decentralized venues.

Together with its other products: Liquidity Hub for aggregated liquidity and Perpetual Hub for decentralized on-chain perpetual futures, Orbs protocols have been implemented by 14 prominent DEXs spanning 8 chains.

Join the support telegram channel for more information regarding both advanced order types.

Find out more info:

- dTWAP webpage

- dLIMIT webpage

- Whitepaper

- Security audits (1,2)