Thena integrates dLIMIT & dTWAP powered by Orbs

Thena, one of the largest DEXs on BNB Chain, has integrated the dLimit & dTWAP protocol powered by Orbs!

As a result, Thena traders will now have access to both advanced order types, enabling traders to guarantee the price of their order or break up large orders into smaller trades. This development follows successful integrations with QuickSwap, SpookySwap, SpiritSwap, and Pangolin. With each integration, dLIMIT and dTWAP further solidify Orbs' position as a market leader in DeFi innovation, showcasing Orbs’ novel layer 3 technology for enhancing the capabilities of smart contracts.

dLIMIT is a fully decentralized, permissionless, and composable DeFi protocol developed by the Orbs project and powered by the Orbs network. Thena traders will now have access to the advanced order types at no extra cost. Furthermore, in addition to dLIMIT, Thena will also integrate decentralized time-weighted average price orders (dTWAP) by Orbs, enabling execution of this algorithmic trading strategy.

The integration highlights the close technical collaboration between Orbs and Thena. Both projects actively contributed to making both order types a reality on the exchange. This was possible due to the smart contract audits (1,2) and the robust developer documentation of both protocols.

Orbs is a decentralized protocol executed by a public network of permissionless validators using PoS, staked with TVL valued at over a hundred million dollars. Orbs pioneers the concept of L3 infrastructure, by utilizing the Orbs decentralized network to enhance the capabilities of existing EVM smart contracts, opening up a whole new spectrum of possibilities for Web 3.0, DeFi, NFTs, and GameFi.

Trade CeFi on DeFi

In the past week, Thena supported a transaction volume of 96.4 million dollars at the time of writing. Thena’s offerings include multi-chain swaps, LP locking, governance, and more. dLIMIT & dTWAP will expand the DEX’s current offerings, potentially allowing the project to capture more TVL.

For those who are unfamiliar, a limit order allows users to buy or sell tokens at a specific price or better. While the specified price is guaranteed, the execution of the order is not guaranteed and depends on price movement. Limit orders will only be executed if the market price meets the order qualifications.

In contrast, a TWAP order is an algorithmic trading strategy that aims to reduce the impact of large orders on the market by breaking them down into smaller portions that are then executed over time. By executing smaller orders, this approach lessens the price impact and enables traders to gradually acquire various assets over a specific period.

Thena’s traders can now utilize both of these key traditional finance orders without sacrificing on decentralization.

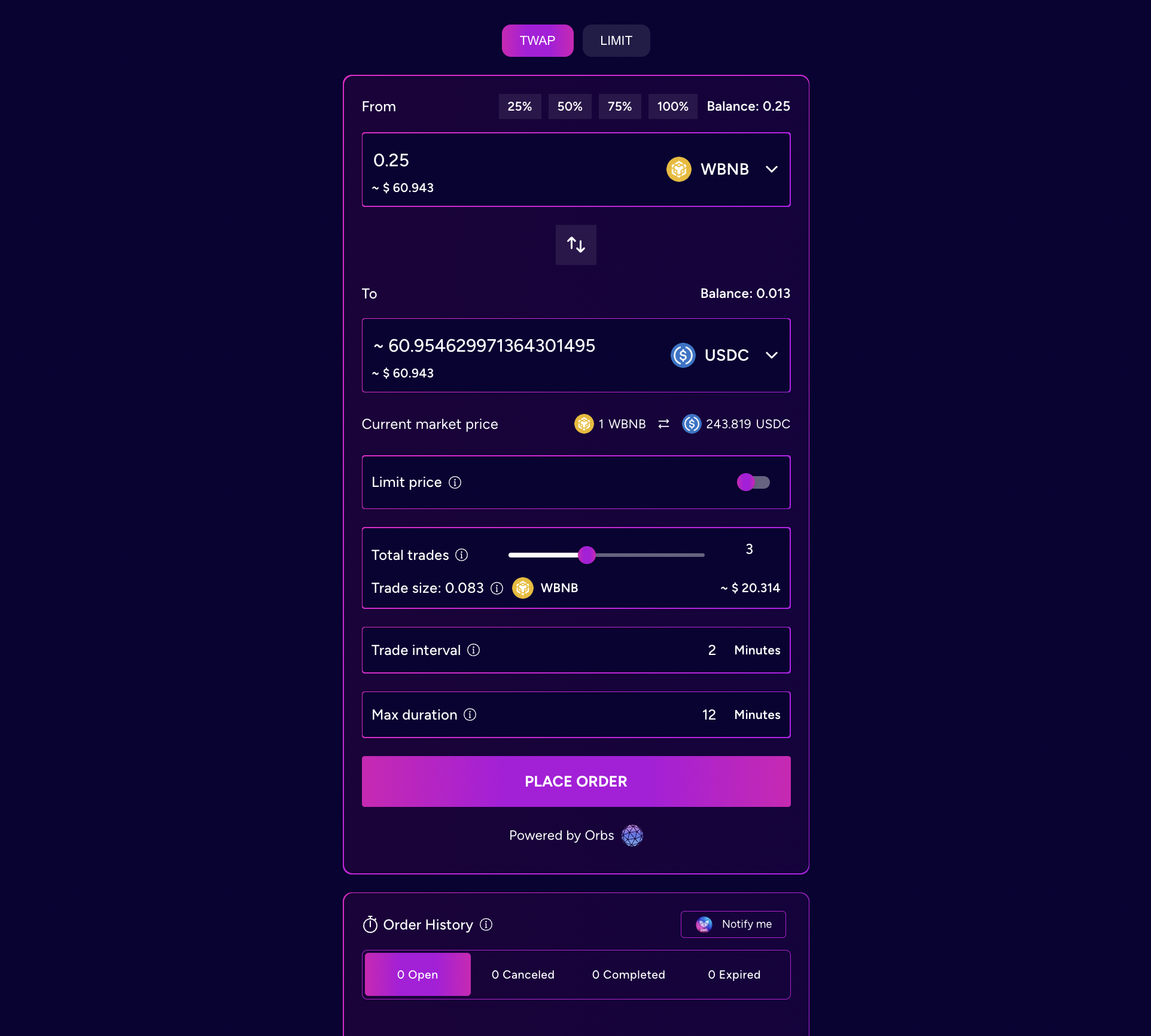

Setting up a dLIMIT and dTWAP orders

When switching to a dLIMIT ‘swap’ on Thena, users are presented with an easy-to-follow user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLIMIT order, traders must specify the following:

- From: The token that they currently have

- To: The token that they wish to swap for

- Limit price: Trades will ONLY be executed when the available market price is equal to or better than the limit price

dLIMIT configuration is simple, albeit robust, and takes into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order live in the ‘order history’ tab.

For a dTWAP order, three additional parameters need to be specified:

- No. of Intervals: allows the user to specify the number of individual trades. The UI automatically calculates the total number of transactions required to complete the entire order and the estimated trading interval.

- Max Duration: the maximum time during which the total amount of individual trades making up the full dTWAP order may be executed.

- Trade Interval: sets the time gap between each individual trade. The user can edit this parameter, which also results in changes to the corresponding trade size and number parameters.

Similarly to dLIMIT, these parameters provide significant flexibility in customizing each order, taking into account factors like market conditions and current gas fees. Additionally, the UI facilitates both dTWAP-market orders, which execute all trades at the available market price, and dTWAP-limit orders, which only execute individual trades if they are within the price limit set by the user. Once these parameters are set, the user can approve the specific source token, place the order, and review their specified configuration.

Industry-leading DeFi Innovation

The dLIMIT & dTWAP protocol, powered by Orbs L3 technology, has become the industry standard for decentralized algorithmic orders in DeFi. With integrations on 5 prominent DEXs spanning 4 chains, these integrations have helped facilitate a trading volume of over $200M over the past week at the time of writing. Keep an eye out for future updates on the collaboration between Orbs and Thena.

For more information regarding both advanced order types, join the dTWAP support Telegram channel.